Facing the Deadline: Why Funding Your Property Purchase Is More Urgent Than Ever

Getting the money together to buy a home is one of the biggest challenges facing buyers today. With changing market conditions and ongoing shifts in lending policies, the path to funding your property purchase can seem tricky—and sometimes, the opportunity can close faster than expected. If you’re not prepared, you might miss out on your dream property. Did you know that a delay of just a few weeks can mean losing favourable mortgage deals or even the chance to secure the property you want?

The process of funding your property purchase is more than just saving a deposit—it’s a series of choices, checks, and professional support that can either get you the keys to your new home or leave you back at square one. Timing is everything. Lending criteria are tighter, and the number of homes for sale is always shifting. If you don’t know your options or how to move fast, you might discover that the “perfect property” has already slipped away to a better-prepared buyer. Learning how to fund your purchase smartly isn’t just important; it’s essential.

Demystifying Property Funding: Knowledge Every Homebuyer Needs Today

So, what does “funding your property purchase” really mean? In simple terms, it’s putting together the right mix of money, loans, and planning to buy a property outright. For most people in the UK, this starts with a mortgage—a specialist loan designed just for buying homes. The amount you can borrow depends on your savings, earnings, credit score, and sometimes even the specific property type. Getting this right is the make-or-break part of the buying journey.

But funding is more than just a bank loan—there are government help-to-buy schemes, family gifted deposits, shared ownership options, and more. Failing to know about these choices can mean missing out on better offers or paying more over time. The stakes are high. Without the right advice and support, buyers might face delays, rejected mortgage applications, or offers falling through. Understanding the funding journey not only makes the process smoother, it gives you a real edge in today’s competitive market.

Why Being Informed About Funding Your Property Purchase Transforms Your Buying Experience

Turning to experienced professionals makes all the difference when it comes to funding your property purchase. Estate agencies that combine mortgage skills, local property knowledge, and a personalised touch can smooth out even the bumpiest paths. With expert guidance, you’ll learn about the best funding routes—whether it’s fixed-rate mortgages for peace of mind, advice on government support, or clear breakdowns of the full costs involved.

For many buyers, this support means less worry and fewer surprises. You’ll avoid common mistakes like underestimating the time needed for approval, forgetting about “hidden” fees, or overlooking a valuable grant. The right advice turns property funding from a stress-filled guesswork to a step-by-step journey with experts backing you up all the way. As a result, you’re more likely to secure the property you want and move in on your own terms—feeling confident about your investment.

The Competitive Edge: What Makes Estate Agencies Different in Property Funding Support

Not all estate agencies offer the same level of support when it comes to funding your property purchase. Some stand out for their honest approach, staying by your side from the first viewing right through to move-in day. They focus on sharing timely advice, clear information, or arranging meetings with specialist mortgage advisors directly in their local offices. Others hold the edge with customer care—building trust, explaining every step in easy terms, and responding quickly to questions or concerns so you can stay one step ahead.

For example, agencies that blend their property sales expertise with in-house mortgage advisers can streamline everything for you. This can speed up loan offers, flag up the best deals based on your circumstances, and prevent you from wasting time with unsuitable lenders. Some also help sellers or landlords, connecting property management services with buyers or tenants who one day may wish to own. This full-circle approach helps buyers at every stage, creating a smoother transition from viewing to moving in.

Timing and Know-How: How Good Guidance Gives You the Upper Hand

In property, timing can be as important as money. Changes in mortgage deals, updates in government schemes, or even new properties coming onto the market can turn yesterday’s “no” into today’s “yes.” Experienced estate agencies stay on top of these changes, giving buyers instant updates so they can move fast—and smart. By understanding what’s available and having paperwork ready to go, buyers are less likely to miss out due to slow responses or uncertainty.

Knowing the process means knowing the questions to ask. What documents do I need? How much can I really borrow? Which scheme fits my situation? Estate agencies that take the educational approach empower you with these answers. They don’t just push properties—they teach you the steps, protect you from surprises, and help you build long-term knowledge for the next move up the ladder. The more you know, the faster you can act.

Practical Tips: Getting Ready to Fund Your Property in Today’s Market

Start by reviewing your finances—know your savings, your monthly income and outgoings, and your credit score. Gather key documents such as proof of earnings, ID, and past addresses. Book in with a mortgage adviser before you fall in love with a property—that way you’ll know exactly what you can afford and how quickly you can move when the right place comes up.

Don’t overlook government help or local programmes that might boost your deposit or reduce costs. Ask your agency for advice on these schemes—they should understand how these apply in your area and for your property type. And remember: good estate agents are more than matchmakers for homes; they’re guides for every financial step of the way.

Dumfries Mortgage & Property Shop: A Commitment to Support and Education

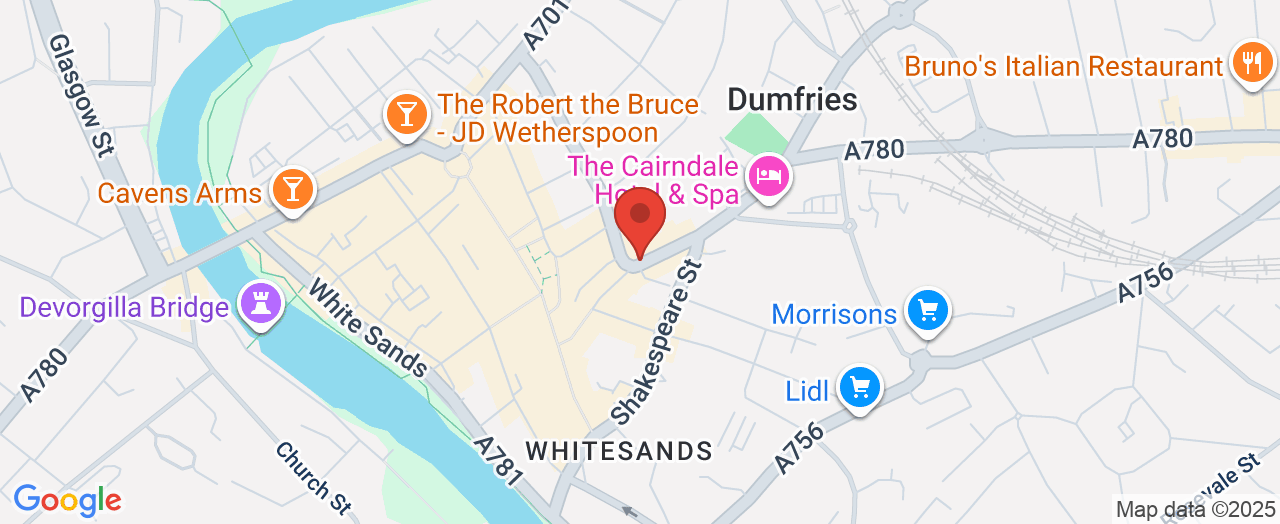

Dumfries Mortgage & Property Shop has built its reputation around clear advice and client care in funding property purchases. The website conveys a strong local connection, offering a mix of property sales, lettings, and mortgage guidance, all under one roof—directly on English Street in Dumfries. Their approach blends professionalism with a genuine aim to keep the process hassle-free for everyone involved: buyers, tenants, and landlords alike.

What stands out is the agency’s commitment to quick responses and supportive guidance, whether assisting first-time buyers or seasoned movers. The team’s friendly, helpful tone, as highlighted in online reviews, matches their mission to make stressful situations smoother and help clients feel comfortable at all stages. For anyone unsure about property funding, this commitment to education and tailored advice offers a distinct advantage: it begins with listening, continues with practical solutions, and ends with successful property ownership or management.

Real-World Success: Reducing Stress and Delivering Results in Property Funding

Smooth property purchases don’t just come down to luck—they’re created by experienced professionals who care about every step. Buyers and renters alike have seen how the mix of guidance and kindness can turn stressful times into smooth handovers.

Recently purchased a home from DMPS and from first viewing to handover of keys the team especially Georgia and Raymond were extremely helpful. They were friendly, professional and always happy to help. Just what is needed in what can be a stressing time. Would highly recommend.

Experiences like this show what a difference good support can make in funding your property purchase. Quick replies, kindness, and clear answers aren’t just “nice to have”—they make real results possible. With the right team supporting you, anyone can move through the buying journey with greater confidence and much less stress.

Property Funding Today: Staying Ahead Means Acting Now

In today’s property market, securing funding for your purchase isn’t something to leave to chance or last-minute decisions. Education, preparedness, and timely support mean the difference between securing your desired home and losing out. With expert agencies guiding you through loans, government aid, and property choices, the whole experience becomes clear and manageable.

Dumfries Mortgage & Property Shop’s focus on tailored advice and local expertise helps buyers understand every funding option available. Funding your property purchase is about confidence, clarity, and smart choices—a process that starts with good information and ends with new keys in your hand.

Contact the Experts at Dumfries Mortgage & Property Shop

If you’d like to learn more about how funding your property purchase could benefit your move or investment plans, contact the team at Dumfries Mortgage & Property Shop.

📍 Address: 63 English St, Dumfries DG1 2DA, United Kingdom

📞 Phone: +44 1387 249304

🌐 Website: http://www.dumfriesmortgageandpropertyshop.co.uk/

Dumfries Mortgage & Property Shop’s Location and Opening Hours

🕒 Hours of Operation:

📅 Monday: 9:30 AM – 3:30 PM

📅 Tuesday: 9:30 AM – 3:30 PM

📅 Wednesday: 9:30 AM – 3:30 PM

📅 Thursday: 9:30 AM – 3:30 PM

📅 Friday: 9:30 AM – 3:30 PM

📅 Saturday: ❌ Closed

📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment